PrimeXBT’s VIP 2 Welcome Campaign Slashes Fees for Futures Traders

PrimeXBT, the popular cryptocurrency exchange, is offering among the lowest trading fees in futures markets. The company has introduced a VIP campaign for crypto futures trading where new users receive VIP 2 status automatically for 10 days, unlocking 0.01% maker and 0.015% taker fees immediately. It’s a PrimeXBT bonus in the most practical sense; lower overhead on every order, from the first trade onward. The status is applied automatically, so there’s no opt-in step before trading.

For traders running a scalping crypto strategy or comparing the lowest crypto exchange fees, the percentage gap is decisive. PrimeXBT pairs the welcome pricing with up to 500x leverage and a professional, data-heavy interface.

Cost Per Trade: A Clear Binance and Bybit Comparison

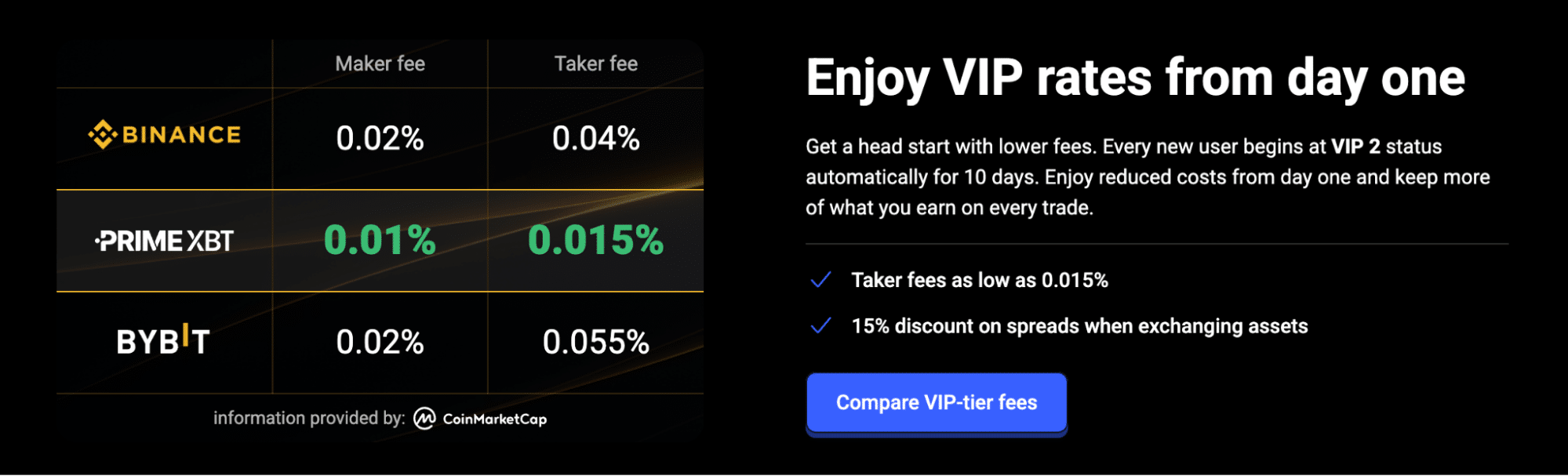

Compared to some of the top exchanges, PrimeXBT charges the lowest trading fees. PrimeXBT’s VIP 2 taker fee is just 0.015%. In comparison, Binance charges a futures taker fee of 0.04%, while Bybit takes a 0.055% taker fee for USDT perpetual and futures contracts.

The division is also clear on the maker fees: PrimeXBT charges just 0.01% on VIP 2, while both Binance and Bybit charge 0.02% maker rates for their starting tiers. For comparison, at a $10,000 per taker trade, PrimeXBT saves $2.50 versus Binance and $4.00 versus Bybit.

Multiply that by 100 trades, and the difference becomes $250-$400 saved on identical turnover, which is capital that stays in the trader’s account rather than being siphoned off as friction.

PrimeXBT also advertises a 15% discount on spreads when exchanging assets. Across 100 conversions, the saving is 15% of whatever spread cost you would otherwise pay, a useful lever for crypto margin trading workflows.

Click here to learn more about margin trading.

Liquidity, Speed, and 500x Leverage

Fee savings can be wiped out if execution degrades in fast markets. PrimeXBT highlights deep liquidity, ultra-fast execution, and low slippage even during volatile periods, and it points to a proprietary order book as part of its execution model.

PrimeXBT’s leverage cap sits at up to 500x, making it a high-leverage crypto exchange for experienced participants who want capital efficiency. Leverage allows a trader to control larger notional exposure using less margin, but it also increases sensitivity to adverse moves. This is exactly why execution quality and risk controls have to be considered alongside fees.

One-Screen Analysis and Position Protection: Built-In Charting and Isolated Margin

PrimeXBT integrates TradingView within its futures platform, enabling technical analysis without leaving the order screen. That integrated workflow matters when entries and exits are time-sensitive.

On risk management, the platform promotes isolated margin, allowing traders to isolate the margin assigned to a single position rather than putting the whole balance at stake. Since leverage magnifies both profit and loss, disciplined sizing and controls are non-negotiable.

PrimeXBT also markets breadth. Alongside BTC/USDT and ETH/USDT contracts (including ETH USDT futures), it lists markets such as SOL/USDT, RIVER/USDT, PAXG/USDT, and ZEC/USDT, coverage that lets traders keep strategies in one place instead of hopping between platforms.

The PrimeXBT VIP Program

PrimeXBT’s VIP structure is built around trading activity rather than lock-ups or platform tokens. All new users start with VIP 2 status for 10 days, giving immediate access to the platform’s lowest taker fees. Once the introductory period ends, accounts are reassessed based on rolling 30-day trading volume and placed into one of three tiers: Regular, VIP 1, or VIP 2.

Each tier offers progressively stronger taker fee discounts, with VIP 1 delivering a substantial reduction and VIP 2 unlocking the maximum savings available on the platform. Maker fees remain consistent across all tiers, which keeps cost calculations predictable regardless of volume changes. Importantly, once a VIP tier is reached, it is locked in for 30 days, so traders are not downgraded mid-cycle if activity briefly slows.

Beyond pricing, PrimeXBT positions VIP status as a broader service upgrade. Higher tiers come with operational perks such as priority 24/7 support and instant, free withdrawals, making the programme attractive not just for lower fees, but for smoother day-to-day trading as well.

Security and a Responsible Reminder for Derivatives Trading

PrimeXBT states it uses hardware security modules rated FIPS PUB 140-2 Level 3 or higher, geographically distributed security infrastructure, and cold storage with multisignature technology.

Risk Disclaimer: A sensible reminder applies to any crypto derivatives platform: trading involves risk. Leverage may magnify losses, and futures are derivative contracts that commit parties to buy or sell an asset at a later date. Use risk limits, avoid oversized positions, and treat isolated margin and stops as mandatory tools, not optional extras.

Call to Action: Try VIP 2 Pricing and Let the Maths Speak

PrimeXBT’s appeal comes down to control. In crypto futures trading, fees are one of the few variables traders can actually manage, and even small percentage differences add up quickly over time. With VIP 2 pricing set at 0.01% for makers and 0.015% for takers during the 10-day welcome period, the platform gives traders a clear way to measure how lower costs affect real performance, especially for strategies that rely on frequent execution.

For traders who want to improve results by reducing friction rather than chasing unpredictable price moves, PrimeXBT’s VIP 2 welcome offer offers a practical starting point to test whether the maths works in their favour.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.