Why LiquidChain Is the Gold Standard for Connecting BTC, ETH, and SOL

Very few crypto projects are tackling problems that actually matter at scale. LiquidChain ($LIQUID) stands out because it is not chasing short-term pumps.

Instead, it focuses on one of the most expensive inefficiencies in crypto today: liquidity fragmentation across Bitcoin, Ethereum, and Solana. With its presale already showing strong conviction, LiquidChain could potentially be a serious contender.

At a time when capital is more selective, and infrastructure matters more than anything else, LiquidChain’s approach is resonating. It is not trying to replace existing blockchains. It is trying to connect them, and that distinction is exactly why the project is drawing attention early.

The Core Challenge: Liquidity Trapped in Silos

Bitcoin, Ethereum, and Solana dominate the crypto market. Together, they hold the majority of on-chain value, users, and developer activity. Yet despite this dominance, they operate in largely isolated ecosystems. Liquidity on Bitcoin cannot easily interact with Ethereum DeFi. Solana’s speed does not automatically translate into access to Ethereum’s capital. Every ecosystem moves forward, but mostly on its own.

This fragmentation creates several problems. Billions in capital remain siloed, unable to flow freely to where it is most efficient. Users who want to move across chains face delays, fees, and security risks through bridges and wrapped assets. Developers are forced to build and maintain multiple versions of the same application just to reach users on different chains. Over time, this redundancy slows innovation and increases systemic risk.

Perhaps most importantly, bridges introduce new attack surfaces. Every additional trust assumption increases the chance of failure, something the market has seen repeatedly over the past few years. As markets tighten, these inefficiencies become harder to ignore. Liquidity does not disappear in bearish conditions; it becomes fragmented and harder to deploy. That is the exact environment LiquidChain is designed for.

How LiquidChain Solves the Cross-Chain Problem

LiquidChain approaches the problem from a different angle. Instead of moving assets between chains, it coordinates execution across them. Built as a Layer-3 architecture, LiquidChain sits above existing blockchains and unifies how liquidity is accessed and used.

At the technical level, LiquidChain creates unified liquidity pools where assets from Bitcoin, Ethereum, and Solana are verifiably represented without relying on traditional wrapping mechanisms. A high-performance virtual machine handles real-time execution, while trust-minimized cross-chain proofs ensure that Bitcoin UTXOs, Ethereum states, and Solana accounts can interact securely and atomically.

This means capital can behave as if it exists in one system, even though it originates from different chains. Developers can deploy applications once and access liquidity across multiple ecosystems. Users can interact with cross-chain DeFi without manually bridging assets or managing multiple workflows. The result is deeper liquidity, faster execution, and fewer points of failure.

LiquidChain strengthens them by making their liquidity more efficient. That is why it is often described as connective infrastructure rather than just another network.

Why This Matters for the Next Market Cycle

As crypto matures, coordination becomes more valuable than raw speed or isolated innovation. The next phase of growth is less about launching new chains and more about making existing ones work together. Projects that enable that coordination tend to become foundational rather than optional.

LiquidChain’s relevance increases in uncertain market conditions. When liquidity tightens, inefficiency becomes costly. Infrastructure that reduces friction naturally attracts usage. This is why many investors now see LiquidChain not just as another presale, but as a protocol aligned with how the market is evolving.

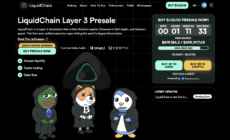

That alignment is reflected in presale participation. The crypto presale for $LIQUID has already raised nearly $500,000, with funding steadily increasing and staking participation showing long-term intent rather than short-term speculation. Early pricing still reflects development-stage risk, but that window does not stay open indefinitely.

Crypto Presale Momentum and the Role of $LIQUID

The $LIQUID token sits at the center of the ecosystem. It is used for execution, governance, and staking, making it integral to how the network operates. Supply is capped, and staking incentives are designed to reward early participation while gradually tightening circulating supply as adoption grows.

This encourages commitment. Early participants are not just buying exposure; they are actively securing the network and aligning with its long-term growth. As more tokens are staked, reward rates adjust downward, naturally favoring those who enter earlier in the presale cycle.

With the presale price still discounted and scheduled to increase over time, the current phase offers a clear risk-reward setup.

Why LiquidChain Sets the Gold Standard

What separates LiquidChain from most presales is focus. It addresses a clearly defined problem, offers a technically coherent solution, and shows early signs of conviction from participants. It is not built around trends that fade quickly. It is built around infrastructure that becomes more important as the market grows.

Well, LiquidChain offers exposure to a protocol designed to connect the most important blockchains in the ecosystem. That role is not dependent on hype cycles or single-chain dominance. It benefits from the continued relevance of Bitcoin, Ethereum, and Solana themselves.

With the crypto presale still active and early participation accelerating, LiquidChain is positioning itself as a foundational layer for the next phase of crypto adoption. That is why many now view $LIQUID as the gold standard among presales focused on real utility.

Join the LiquidChain community on X.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.