LiquidChain Ranks as a Leading Performer in Early 2026 as Cross-Chain Demand Grows

2026 has started on a stronger note for crypto. Markets are showing early signs of recovery, volatility is stabilizing, and capital is slowly rotating back into projects with clear fundamentals. In this environment, the focus remains on infrastructure. That is why LiquidChain ($LIQUID) is starting to stand out as one of the leading crypto projects right now.

LiquidChain launched its crypto presale at a moment when the market is becoming more selective. Instead of chasing narratives, capital is moving toward platforms that solve real problems.

With a Layer-3 design built to unify liquidity across Bitcoin, Ethereum, and Solana, LiquidChain checks many of the boxes investors look for in a new market phase.

The Core Challenge Holding Crypto Back

Liquidity in crypto remains fragmented. Bitcoin, Ethereum, and Solana each hold deep pools of capital, but that capital is locked inside separate ecosystems. Moving assets across chains often requires bridges that introduce delays, fees, and additional security risks. For DeFi users, this creates friction. For developers, it creates redundancy.

Several problems stem from this structure. Billions in liquidity sit idle within siloed networks. Developers are forced to build the same application multiple times across chains. Users and protocols operate in isolation, limiting scale and efficiency. Bridges add extra trust assumptions and attack surfaces, which become even more concerning during periods of lower liquidity.

These issues become more visible during slower markets. When volume drops and capital becomes cautious, inefficiency carries a higher cost. This is the environment LiquidChain is designed for.

How LiquidChain Solves Cross-Chain Fragmentation

LiquidChain approaches the problem from a different layer. Instead of launching another standalone blockchain, it acts as a Layer-3 execution and settlement network that sits above existing chains. Its purpose is to coordinate how liquidity and execution work across ecosystems, rather than competing with them.

The platform allows assets from Bitcoin, Ethereum, and Solana to be verifiably represented within unified liquidity environments. Bitcoin contributes settlement strength, Ethereum provides programmable logic, and Solana brings speed. LiquidChain connects these strengths so they can operate together within a single framework.

Cross-chain proofs and messaging ensure that states from different networks can interact securely and atomically. This reduces the need for constant bridging and minimizes fragmentation. Developers can deploy applications once and access liquidity across chains at the same time. Capital becomes more flexible, and execution becomes more efficient.

This focus on coordination rather than expansion is what separates LiquidChain from many early-stage projects. It targets a structural weakness that exists regardless of market direction.

Crypto Presale with Tokenomics Built for Longevity

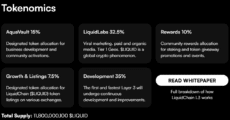

LiquidChain’s tokenomics are structured to support development, participation, and ecosystem growth. The total supply is capped at 11,800,000,100 $LIQUID, with allocations designed to avoid short-term imbalance.

Development receives 35% of the supply, ensuring continuous improvement of the Layer-3 network. LiquidLabs holds 32.5%, allocated toward ecosystem expansion, partnerships, and global reach.

AquaVault accounts for 15%, supporting business development and community activation. Rewards receive at 10%, dedicated to staking incentives and community programs. Growth and listings make up the remaining 7.5%, supporting future exchange access and network expansion.

Combined with staking mechanics, these tokenomics support long-term participation. This structure strengthens the case for LiquidChain as a crypto presale focused on sustainability rather than hype.

Why the $LIQUID Crypto Presale Is Gaining Momentum

The $LIQUID crypto presale has already raised over $300,000. Current presale pricing remains low relative to long-term targets, with staged increases scheduled every few days. This rewards early participation while maintaining a clear progression toward later phases.

Staking is available during the presale, allowing early participants to align with the network ahead of launch. Staking rewards are higher in the early stages and gradually adjust as more tokens enter staking pools.

Unlike many presales that rely on aggressive marketing, LiquidChain’s momentum is driven by its positioning. Cross-chain scaling is becoming more important as crypto matures, and platforms that improve capital efficiency tend to attract attention before full market recoveries.

As presale stages advance and market conditions continue to improve, current pricing and staking dynamics may not remain available for long.

Explore LiquidChain and its ongoing crypto presale on X. Check the whitepaper.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.